Swapping a floating rate for a fixed rate

In the commercial loan world, pricing is frequently tied to a floating (variable) rate

A SWAP is a derivative product by which two parties (the borrower and swap provider) enter into an ancillary contract that complements, but does not modify, the loan terms. In most instances, the swap provider will be the bank that makes the loan.

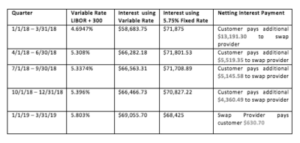

For illustration purposes, we’ll consider a hypothetical $5 million loan backdated to January 1, 2018, secured by real estate, with quarterly payments of accrued interest, fixed $60,000 quarterly principal payments, a five-year maturity, and a floating rate equal to 3-month LIBOR plus a spread of 300 basis points.

The standard floating rate structure

There are various alternative floating formulas, with 1-month and 3-month LIBOR serving as common indices. The LIBOR index (and overall variable rate) re-sets each month or quarter, as applicable, often as of 11 a.m. London, England, 2 business days

For our loan, on January 1, 2018, the 3-month LIBOR rate would have been set using the 3-month LIBOR rate as of December 28, 2017 (which was 1.6947%), resulting in an initial all-in variable rate of 4.6947%.

Consider a SWAP on the variable rate loan described above. The rate will be set at the time the SWAP is closed, but for illustration purposes, we’ll assume a swapped, fixed rate of 5.75%.

The optics and mechanics are confusing. The promissory note will still reflect a floating rate, and the borrower will continue to pay interest based on a floating interest rate. Simultaneously, however, there is an offsetting transaction in which the borrower and swap provider exchange funds to net a 5.75% fixed rate loan to the borrower.

Looking at rates through April 1, 2019, the swapped fixed rate exceeds the variable rate for all of the payments, except the April 1, 2019 payment.

Pricing

SWAP pricing is premised on market expectations of changing future interest rates as determined by brainy financiers versed in calculus. These people think in terms of slopes, curves, and standard deviations, and have little familiarity with college fraternity swaps.

Any quoted pricing is merely indicative and can change by the second until “confirmed.” Often, a SWAP on a typical commercial loan is not locked until the loan closes, although a borrower can purchase a “forward swap.” A SWAP can also be executed later in the life of the loan.

Early Termination

In our example, the term of the SWAP matches the five-year term of the loan. But what happens if the borrower decides to sell the underlying real estate or refinance the loan at, say, Year 3? There are two possibilities. If the loan is being refinanced, the SWAP could be “novated” to the next loan. More likely, the borrower will simply break the SWAP. Depending on the then-market rates, the SWAP might be “in the money” (resulting in a payment to borrower for the then-value of the swap) or “under water” (resulting in the borrower having to pay a breakage fee). Following the Great Recession, many a borrower was saddled with an underwater swap and a high breakage fee that locked the borrower into the loan for the full term of the SWAP.

Instinctively, a person might think that if the fixed rate by the swap was 5.75% and the going rate was 6.25%, then the swap would be “in the money.” Not so quick. The value of the SWAP is not a function of a rate at a single point in time but involves a discounted present value calculation of the future cash flows using the interest rate curve for the remaining life of the SWAP. Do not assume that your SWAP has value merely because interest rates rise.

The SWAP documents

Your bank will either (i) not allow swaps, (ii) have a preferred third-party swap provider, or (iii) be a swap provider. We will assume the lending bank is also the swap provider, but since the swap transaction will likely be handled by a different department of the bank, we will call the bank group handling the SWAP the “swap provider.”

The swap provider will educate the borrower, provide disclosures, and confirm for itself that the borrower is sufficiently sophisticated to use a SWAP. The swap provider will also review financial certifications, confirm eligibility through the borrower’s and guarantors’ representations, and provide optional structures and pricing. The parties then enter into the SWAP documents, which will likely include (a) an ISDA Master Agreement, and (b) a Schedule detailing the transaction.

The ISDA Master Agreement is a voluminous, complex, largely non-negotiable contract that governs the relationship. The terms of the swap are contained in the Schedule and a “Confirmation” which follows a recorded call to lock the rate and consummate the transaction.

If a SWAP is desired at loan closing, then the SWAP process should begin at the loan term sheet or commitment letter stage. Reaching the point where the parties can “confirm” a SWAP takes time and additional documentation.

The marriage of the SWAP and loan

The SWAP is usually secured by the same collateral that secures the underlying loan on a pari passu basis. The mortgage secures the SWAP and the loan, the loan guarantors frequently also guarantee the SWAP, and everything is cross-defaulted. The SWAP and the loan are now married.

Eligible contract participants

Federal law governs derivatives and bars non-qualified parties from entering into SWAPs. To qualify as an Eligible Contract Participant (ECP), an entity or person must meet certain financial tests. As a gross oversimplification, a borrowing entity (or the persons backing the entity) must have $10MM in assets or a net worth of more than $1MM. In addition to the borrower, any guarantor of the SWAP must also be an ECP.

There is so much we haven’t touched on. Mark to market. Collars. Inverted curves. Imbedded swaps. The anticipated demise of LIBOR. Syndications, club loans and participations. Non-vanilla swaps.

An interest rate swap is a valuable tool for borrowers to reduce the risk of interest rate increases during the life of a floating rate loan. Still, to misquote Churchill, “[due] diligence is the mother of good luck.

This article originally appeared online at the Mississippi Business Journal on May 13, 2019.

MOLLY JEFFCOAT MOODY and BEN WILLIAMS are attorneys at Watkins & Eager PLLC and are both recognized by Chambers USA and Best Lawyers in America. Molly was chosen as a Top 10 Finalist in the Mississippi Business Journal’s 2019 Top 50 Under 40 business leaders. Additional information is available at www.watkinseager.com.