Download: Recording Fee Sheet

MISSISSIPPI RECORDING FEES

AS REQUIRED BY MISS. CODE ANN. 25-7-9

| Instrument | Archive Fee County* | Non-Archive Fee County |

| DEEDS: Warranty, Timber, Quitclaim, Trustee’s Deeds, Deeds of Trust, Leases, Plats, Covenants, Construction Liens, Lis Pendens, Townhouse and Condominium Liens, Powers of Attorney, UCC filings in land records, Miscellaneous documents, Mobile Home Certificates, etc. Includes indexing for the first 5 pages EACH additional page more than 5 | $26.00 $1.00 | $25.00 $1.00 |

| EACH: Assignment, Partial Release, Release, Amendment, Cancellation, Authority to Cancel, Amendment of Supplement to Covenants, Subordination, Modification, Substitution of Trustee Etc. Includes indexing for the first 5 pages and marginal notation EACH additional assignment, release, etc. EACH additional page more than 5 | $27.00 $26.00 $1.00 | $26.00 $26.00 $1.00 |

| Oil & Gas Leases, Mineral Deeds, Royalty Deeds, Etc. Includes indexing for the first five pages EACH additional section or subdivision lot EACH additional page more than five | $26.00 $1.00 $1.00 | $25.00 $1.00 $1.00 |

| EACH: Oil & Gas Release / Cancellation / Assignment Includes the first five pages For Assignment: Each additional book and page listed EACH section or subdivision lot EACH additional page more than five EACH additional book and page marginal notation when applicable For Assignment: Each additional assignee | $26.00 $4.00 $1.00 $1.00 $1.00 $18.00 | $25.00 $4.00 $1.00 $1.00 $1.00 $18.00 |

* The following counties collect the $1.00 archive fee: Adams, Alcorn, Amite, Attala, Benton, Calhoun, Chickasaw, Claiborne, Clarke, Clay, Coahoma, Copiah, Covington, Franklin, Greene, Grenada, Hancock, Harrison, Hinds, Holmes, Issaquena, Jackson, Jasper, Jefferson, Jefferson Davis, Jones, Lauderdale, Leake, Lincoln, Lowndes, Madison, Marion, Monroe, Neshoba, Noxubee, Oktibbeha, Panola, Perry, Pike, Pontotoc, Quitman, Rankin, Scott, Simpson, Sunflower, Tate, Tippah, Union, Walthall, Washington, Wayne, Wilkinson, Winston, Yalobusha, and Yazoo.

| Mineral Documentary Stamp Tax (Miss. Code Ann. 27‐31‐79) | Amount Per Mineral Acre |

| Furnishing Minerals on Deeds are: | $0.08 |

| Leasehold Estate – Primary Term of: 1 – 10 Years | $0.03 |

| Leasehold Estate – Primary Term of: 11 – 20 Years | $0.06 |

| Leasehold Estate – Primary Term of: 20+ Years | $0.08 |

NOTE: Mineral Stamps if applicable are $1.00 minimum

| Furnishing Copies: | Per Page |

| Performed by Clerk or employee | $0.50 |

| If performed by any other person | $0.25 |

| Certified Copies (each complete document) | $1.00 |

Download: Mississippi Formatting Requirements

MISSISSIPPI FORMATTING REQUIREMENTS

FOR RECORDABLE INSTRUMENTS

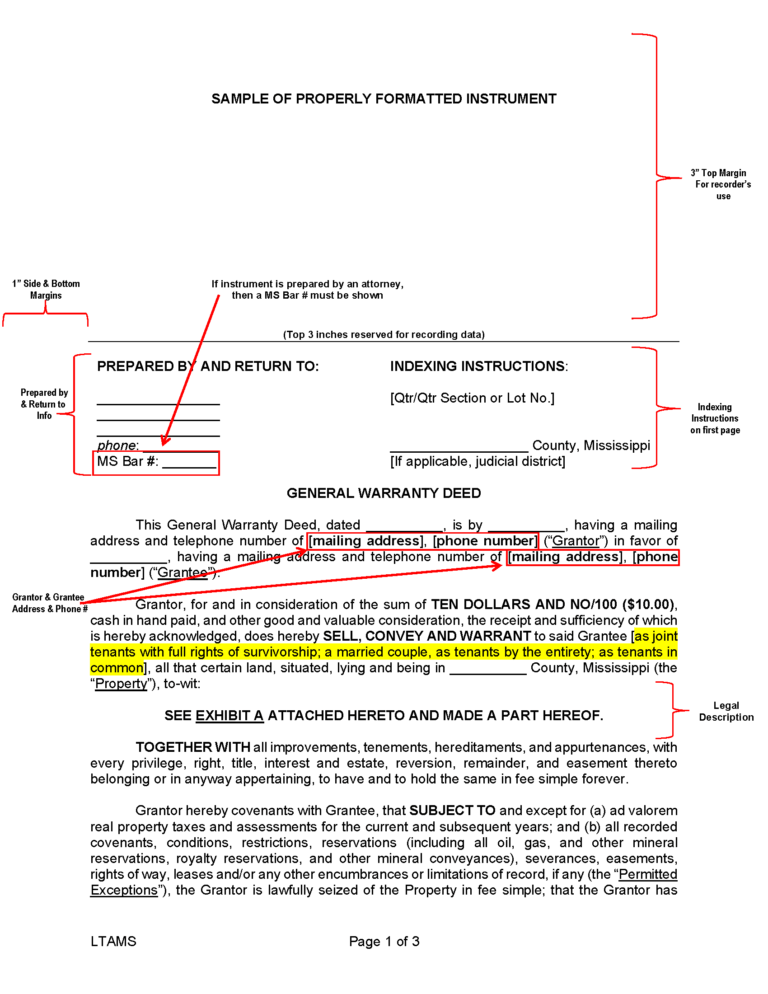

Effective July 1, 2021,[1] any document or instrument presented to the clerk of the chancery court in Mississippi for recording must:

- in the case of a paper document, contain original signatures; or

- in the case of an electronic document, contain electronic signatures that comply with the Uniform Real Property Electronic Recording Act.

Effective, July 1, 2009,[2] any document or instrument presented to the clerk of the chancery court in Mississippi for recording must also meet the following requirements:

- Paper:

- The document shall consist of one or more individual pages printed only on one (1) side.

- The document (other than a plat or survey or a drawing related to a plat or survey) shall be on white paper of not less than twenty-pound weight.

- Margins:

- Top Margin of First Page (other than for a plat or survey or a drawing related to a plat or survey): at least three (3) inches which is reserved for the recorder’s use.

- All Other Margins: shall be a minimum of three-fourths (3/4) of one (1) inch.

- Nonessential information such as form numbers or customer notations may be placed in a margin other than the top margin.

- A document may be recorded if a minor portion of a seal or incidental writing extends into a margin.

- Font Size and Color:

- All documents must be printed or typed in a font no smaller than eight (8) points in size.

- Any document (other than a plat or survey or a drawing related to a plat or survey) containing font smaller than eight (8) point type must be accompanied by an exact typewritten or printed copy.

- All text shall be of sufficient color and clarity to ensure that the text is readable when reproduced from the record.

- All documents must be printed or typed in a font no smaller than eight (8) points in size.

- First Page Contents:

- IF a document (other than a plat or survey or a drawing related to a plat or survey) contains any of the following information, THEN it shall have that information on the first page below the three-inch top margin:

- The name, address, telephone number, and bar number,[3] if any, of the individual who prepared the document;[4]

- A return address;

- The title of the document;

- All grantors’ names;

- All grantees’ names;

- Any address and telephone number required by Section 27-3-51;

- Section 27-3-51 requires each “deed” (but to avoid rejection by a clerk, it is good practice to include on all instruments) to contain the following information for each grantor and grantee:

- the current mailing address;

- the current business or employment telephone number, if any; and

- the current residential telephone number, if any.

- Section 27-3-51 requires each “deed” (but to avoid rejection by a clerk, it is good practice to include on all instruments) to contain the following information for each grantor and grantee:

- The legal description of the property OR indexing instruction per Section 89-5-33(3).

- if there is insufficient space on the first page for the entire legal description or the entire indexing instruction, immediately succeeding pages shall be used.

- Signatures:

- All signatures shall be in black or blue ink.

- The corresponding name shall be typed, printed, or stamped beneath the original signature.

- The typed, printed, or stamped name shall not cover or otherwise materially interfere with any part of the document.

- Binding and Attachments:

- The document shall not consist of pages that are permanently bound or in a continuous form and shall not have any attachment stapled or otherwise affixed to any page.

- Exceptions:

- The individual pages of a document may be stapled together for presentation for recording.

- The document may contain a label that is firmly attached, with a bar code or return address.

- Legibility:

- The document shall be of sufficient legibility to produce a clear reproduction.

- Any document (other than a plat or survey or a drawing related to a plat or survey) that is not sufficiently legible, must be accompanied by an exact typewritten or printed copy which shall be recorded contemporaneously as additional pages of the

- Exempt Documents:

- The following documents are exempt from the formatting standards of Section 89-5-24:

- A document executed before July 1, 2009.

- A military separation document.

- A document executed outside the United States.

- A certified copy of a document issued by a court or governmental agency, including a vital record.

- A document where one (1) of the original parties is deceased or otherwise incapacitated.

- A document formatted to meet court requirements.

- A federal tax lien.

- A filing under the Uniform Commercial Code.

- The following documents are exempt from the formatting standards of Section 89-5-24:

- Penalty:

- Failure to conform a document to the above standards does not affect its validity or enforceability, but only its ability to be recorded. The Chancery Clerk may refuse to record a document that does not conform to the above standards and which is not otherwise exempt unless an additional recording fee of Ten Dollars ($10.00) per document is paid.

[1] Miss. Code Ann. § 89-3-1.

[2] Miss. Code Ann. § 89-5-24.

[3] See also Miss. Code Ann. § 89-5-33(3). Any instrument prepared by an attorney must include the attorney’s Mississippi Bar number.

[4] Although Section 89-5-24 was not amended to state it specifically, it is logical that the Mississippi bar number of the preparer (as required by the amendment to Section 89-5-33(3)) would be included with the other “prepared by” information.

Download: Unlicensed Practice of Law

UNLICENSED PRACTICE OF LAW

IMPORTANT NOTICE

A. Preparing Deeds and Deeds of Trust

Preparing a deed of conveyance, deed of trust, mortgage, or contract constitutes the practice of law. Miss. Code Ann. § 73-3-55.

A Chancery Clerk was found to be engaged in the unauthorized practice of law for drafting deeds, deeds of trust, notes, bills of sale and title certificates. Darby v. Mississippi State Board of Bar Admissions, 185 So. 2d 684 (Miss. 1966).

B. Certifying Title to Real Property

Certifying to any abstract of title to real estate constitutes the practice of law. Miss. Code Ann. § 73-3-55.

A title or abstract of title guaranty company incorporated under the laws of this state can make or certify titles to real estate where it acts through some person as agent, authorized under the laws of the State of Mississippi to practice law. Miss. Code Ann. § 73-3-55.

An abstract company with paid-up capital of Fifty Thousand Dollars ($50,000) or more can certify to abstracts of title to real estate through the president, secretary or other principal officers of such company. Miss. Code. Ann. § 73-3-55.

C. Aiding the Unauthorized Practice of Law

It is improper for a lawyer to participate in a loan closing transaction in which the mortgage lender renders legal or quasi-legal services and receives a division of “attorney’s fees.” Ethics Opinion Number 33, of the Mississippi Bar.

D. Proposed Amendments to Mississippi Rules of Appellate Procedure

The Mississippi Supreme Court is considering amending the Mississippi Rules of Appellate Procedure to address the unauthorized practice of law. See In the Matter of: Amendments to the Mississippi Rules of Appellate Procedure and the Mississippi Rules of Professional Conduct, Misc. No. 89-R-99018. Proposed Rule 46, Miss. Rules of Appellate Procedure defines the practice of law and provides certain exceptions to the definition of the practice of law.

Under proposed Rule 46, Miss. Rules of Appellate Procedure, the following matters constitute the practice of law:

- Undertaking to prepare, write, or dictate for other documents or instruments of any character requiring knowledge of legal principles or legal documents or agreements involving or affecting the legal rights of a person. The terms “documents” or “instruments” include, but are not limited to, bills of sale, deeds of conveyance, deeds of trust, mortgages, contracts, last wills and testaments, easements, notes, releases, satisfactions, leases, options, articles of incorporation and other corporate documents, articles of organization and other limited liability company documents, partnership agreements, affidavits, prenuptial agreements, trusts, family settlement agreements, powers of attorney and like or similar instruments, and pleadings and any other papers incident to legal actions and special proceedings.

- Certifying or opining concerning titles to real estate other than such person’s own or in which such person may own an interest.

- Giving advice or counsel to any person, or representing or purporting to represent the interest of any person, in a transaction in which an interest in property is transferred where the advice or counsel, or the representation or purported representation, involves the preparation, evaluation, or interpretation of documents related to such transaction or to implement such transaction or the evaluation or interpretation of procedures to implement such transaction where such transaction, documents, or procedures affect the legal rights, obligations, liabilities, or interests of such person.

- Undertaking to close a transaction involving the transfer of an interest in property via a bill of sale, deed of conveyance, deed of trust, mortgage, contract, or lease.

- Undertaking to close a transaction involving the holding, receiving or disbursing the funds of a third person.

Under proposed Rule 46, Miss. Rules of Appellate Procedure, the following matters do not constitute the practice of law:

- A lawyer not admitted to practice in Mississippi or a title company may close a transaction and/or hold, receive and/or disburse the funds of a third person in another state in which such lawyer is admitted to practice or such title company is authorized to do business if such transaction involves the transfer of an interest in property in Mississippi if a lawyer admitted to practice in Mississippi is retained or associated to assist and advise in the preparation of documents to be recorded in Mississippi and other matters governed by Mississippi law to the extent such documents and other matters are supervised by the lawyer admitted to practice in Mississippi.

- A nonlawyer working under the supervision of a lawyer admitted to practice in Mississippi or a lawyer authorized to practice in Mississippi in compliance with Rule 5.5, Mississippi Rules of Professional Conduct, as amended, may close a transaction involving the transfer of an interest in property and/or involving the holding, receiving or disbursing the funds of a third person to the extent such nonlawyer person acts merely as an administrative agent to sign documents and does not give advice or counsel to any person, or represent or purport to represent the interest of any person or entity, in regard to the transfer of any interest in property or the evaluation or interpretation of documents or procedures to implement such transaction or any other matters affecting the legal rights, obligations, liabilities, or interests of any person or entity.

- Acting as a real estate broker or real estate salesperson as authorized by Section 73-35-1, et seq., of the Mississippi Code of 1972, as amended, including without limitation (i) the preparation of a contract for the sale of real estate for which the broker or salesperson is the listing or selling agent or (ii) receiving, holding and disbursing funds comprising earnest money under a contract for the sale of real estate or as part of the closing of a transaction involving the transfer of an interest in real estate for which the broker or salesperson is the listing or selling agent.

- A lender or an employee or principal of a business entity that is a lender making a loan and undertaking any necessary steps to close the loan transaction, including the preparation and negotiation of any document or instrument to which such lender is a party.

- Making abstract or certifying titles to real estate by any title guaranty companies incorporated under the laws of this state where it acts through some person as agent, authorized under the laws of the State of Mississippi to practice law, and making or certifying to abstracts of title to real estate by any abstract company chartered under the laws of the State of Mississippi with a paid-up capital of Fifty Thousand Dollars ($50,000.00) through the president, secretary or other principal officer of such company.

Miss. Code Ann. § 73-3-55. Unlicensed law practice as an offense

It shall be unlawful for any person to engage in the practice of law in this state who has not been licensed according to law. Any person violating the provisions of this section shall be deemed guilty of a misdemeanor, and, upon conviction, shall be punished in accordance with the provisions of section 97-23-43. Any person who shall for fee or reward or promise, directly or indirectly, write or dictate any paper or instrument of writing, to be filed in any cause or proceeding pending, or to be instituted in any court in this state, or give any counsel or advice therein, or who shall write or dictate any bill of sale, deed of conveyance, deed of trust, mortgage, contract, or last will and testament, or shall make or certify to any abstract of title or real estate other than his own or in which he may own an interest, shall be held to be engaged in the practice of law. This section shall not, however, prevent title or abstract of title guaranty companies incorporated under the laws of this state from making abstract or certifying titles to real estate where it acts through some person as agent, authorized under the laws of the State of Mississippi to practice law; nor shall this section prevent any abstract company chartered under the laws of the State of Mississippi with a paid up capital of fifty thousand dollars ($50,000.00) or more from making or certifying to abstracts of title to real estate through the president, secretary or other principal officer of such company.

Miss. Code Ann. § 89-5-33. General index; sectional index; indexing instructions

… To be accepted for recording, an instrument shall state the name, address and telephone number of the person, entity or firm preparing it. If prepared by an attorney, the instrument shall also include the attorney’s Mississippi bar number. The fact that the indexing instruction or preparer information may be omitted, incorrect, incomplete or false shall not invalidate the instrument or the filing thereof for record. …