Qualified Opportunity Zones: An Introduction

The 2017 Tax Cuts and Jobs Act created a new investment model with remarkable tax incentives for capital gains—a model that U.S. Treasury Secretary Steve Mnuchin estimates will see over $100 billion dollars of investment. Indeed, the potential influx of investment is large. For the 2016 tax year, individuals reported around $600 billion worth of gains from the sales of capital assets on their Form 1040, Schedule D. The incentive created: Qualified Opportunity Zones (“QOZ”).

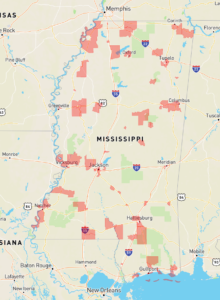

These QOZs were created to spur economic development and job creation in low-income communities. The zones are census tracts based on the definition of “low-income communities” for new market tax credits, and some abutting tracts also qualify. These tracts have already been nominated by state governors and certified by Treasury. Many of these tracts in Mississippi are highly desirable for real estate development, and a link to an interactive map is included at the end of this article. These tracts include:

- The Oxford Square

- Main Streets in Tupelo, Starkville, Hattiesburg, and other cities

- UMMC, Fondren, and Downtown Jackson

- Casinos in Biloxi, Tunica, and Philadelphia

- Ingalls Shipyard in Pascagoula

- Continental Tire in Bolton

- Toyota in Blue Springs

- Portions of industrial parks in Marshall County

Many of these areas already attract industry and development, and with the stimulus of the new tax incentives, they become even more desirable.

Another benefit of this investment model is the ability to pool capital in funds, allowing multiple investors to participate and allowing the fund to make larger purchases and more significant improvements. Commercial property is the likely target, and if this model gains traction, the title industry stands to benefit.

Tax incentives

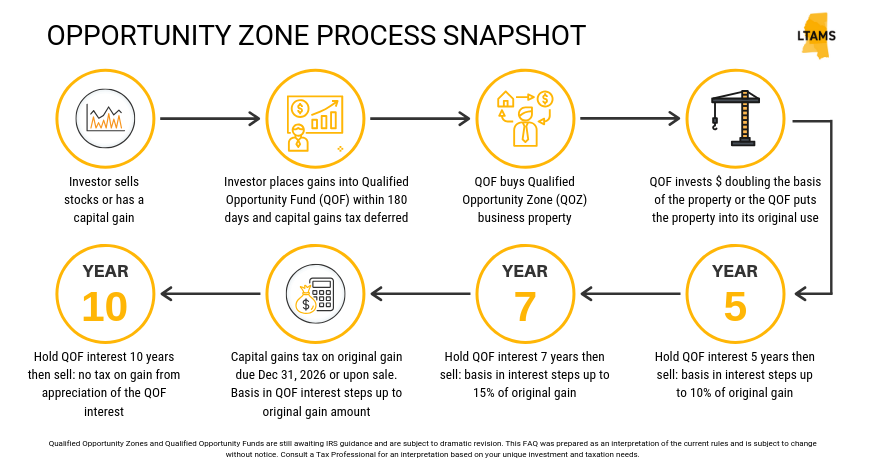

The tax incentives apply to capital gains. To qualify for the benefits, the taxpayer-investor must invest capital gains into a Qualified Opportunity Fund (“QOF”) that invests in QOZ property. The benefits only apply to gains from a sale or exchange of property (e.g., stocks, real estate, art, etc.) with an unrelated person invested in a QOF within 180 days. Both short-term and long-term capital gains qualify.

There are two primary benefits—a deferral and an exclusion—and the two are separate but related. It may be helpful to think of the benefits in terms of “old gain” and “new gain.” The old gain is the gain from the original sale or exchange. The new gain is the gain on the sale or exchange of the interest in the QOF.

As to the old gain, the tax on this gain is deferred until the earlier of (a) the date the QOF investment is sold or exchanged, or (b) December 31, 2026. The tax due on this old gain will be reduced by 10 percent if the taxpayer holds their QOF investment for five years, and 15 percent if held for seven years. At both times, the taxpayer’s basis in the QOF investment steps up a proportional amount. When the tax on the old gain is eventually paid, the basis in the QOF investment steps up to the old gain amount—the amount originally invested in the QOF.

By way of example, consider the following scenario. A taxpayer has a $1 million capital gain that she invests into a QOF. Assume a 20 percent capital gains rate for simplicity. Here are her tax consequences for selling the investment in different years:

| Year | Fed Tax Paid | Fed Tax Savings | |

| Year 0 | $200,000 | $0 | $1M x 20% rate |

| Year 5 | $180,000 | $20,000 | $1M – 10% basis step up x 20% rate |

| Year 7 | $170,000 | $30,000 | $1M – 15% basis step up x 20% rate |

While this deferral and basis step up is appealing, the exclusion benefit for the new gain is potentially the most alluring benefit under the new law. If the QOF investment is held for 10 years, the basis in the property steps up to the fair market value of the investment on the date it is sold. Thus, the entire gain from the appreciation of the investment passed tax-free. These tax savings can be significant if the property appreciates at a high rate. The tradeoff is the investment capital must be tied up for 10 or more years to reap the full reward.

QOF and QOZ property qualifications

For QOF investors to qualify for benefits, the QOF and its assets must meet certain requirements. First, the QOF must be a domestic corporation or partnership organized for the purpose of investing in QOZ property. At least 90 percent of its assets must be QOZ property. There are three types of QOZ property: (1) QOZ stock, (2) QOZ partnership interest, and (3) QOZ business property.

QOZ stock and QOZ partnership interests have essentially the same requirements—the primary difference between the two being the entity form and corresponding type of equity interest. The statute requires (I) these interests to be acquired by the QOF after 2017 solely in exchange for cash, (II) the entity must be a QOZ business, and (III) the business must continue to be a QOZ business for the QOF’s holding period.

A QOZ business is a business that satisfies the following criteria:

- substantially all of the tangible property owned or leased by the taxpayer used in the business must be in a QOZ;

- 50 percent or more of its total gross income must be derived from the active conduct of the business;

- a substantial portion of its intangible property must be used in the active conduct of the business;

- less than five percent of the aggregate unadjusted bases of its property may be attributable to nonqualified financial property—such as debt, stock, partnership interests, options, futures, swaps, and similar property; and

- not a sin business—such as a golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack, casino, and liquor store. That said, there may not be a prohibition on a QOZ business that leases real estate to sin businesses.

QOZ business property is tangible property used in a trade or business that was acquired by the QOF by purchase after 2017. Either the original use of this property must commence with the QOF or the QOF must substantially improve the property. The IRS has ruled that the original use requirement does not apply to land, and the value of the property attributable to land is excluded from the substantial improvement calculation. Rev. Rul. 2018-29, 2018-45 IRB 765.

The substantially improved requirement could limit the feasibility of some projects. Recall that the original use of the property must commence with the QOF, and if not, the property must be substantially improved. To meet the substantial improvement requirement, the QOF must make improvements that double the basis of the property within 30 months. This is something funds must consider in the planning process.

Fund structure

Here is a practical example showing how QOF investments could be structured:

Assume the QOF has $10 million to invest and only wants to hold a portion of its investments in real estate. It could invest $9 million in a QOZ partnership and have the partnership invest 70 percent ($6.3 million) of its assets in QOZ business property. The partnership could then invest five percent ($450,000) of its assets in nonqualified financial property (e.g., stock, debt, index funds, etc.) and hold the remainder in cash. This cash must later be spent pursuant to a written plan for acquiring or improving QOZ property or for QOZ business development. The QOF’s remaining $1 million could also be held in cash, stock, bonds, index funds, or similar property.

By contrast, if the QOF only decided to purchase QOZ business property, it would have to invest the full $9 million in the property alone. There are many potential structures and additional considerations, and the decisions made will depend on the individual circumstances of the taxpayer-investors and fund managers.

Moving forward

The IRS is still in the rulemaking process and has released two rounds of proposed regulations and guidance. Further guidance is expected. Links to the news releases of the proposed regulations are included in the references section below, and these releases contain links to the proposed regulations.

References

26 U.S.C. §§ 1400Z-1, 1400Z-2

Initial IRS Proposed Regulations News Release (Oct 19, 2018)

Second Round of IRS Proposed Regulations News Release (Apr 17, 2019)

Opportunity Zones Map

CDFI Information on Opportunity Zones