Manufactured Homes and the DOR Record Inquiry System

Do you close a lot of real estate transactions that involve manufactured homes? If so, then there’s a service offered by the Mississippi Department of Revenue (the “DOR“) that you may want to consider subscribing to. It’s called a “record inquiry” account.

Why is a “record inquiry” account important?

By default, manufactured homes are classified as personal property and are titled similar to motor vehicles. When a manufacturer produces a manufactured home, they issue a Manufacturer’s Certificate of Origin (“MCO“) or Manufacturers Statement of Origin (“MSO“). This official document is considered to be the “birth certificate” for the manufactured home and contains information about the year model, manufacturer, model name, identification number, weight, etc.

Upon sale, the MCO is then required to be filed with the DOR by the purchaser. The DOR then issues a Certificate of Title (“COT“) to the purchaser. This COT reflects on its face both the name of the then-current owners of the home, as well as any current lienholders. If there are lienholders, then the lienholder generally takes possession of the original COT.

Because they deal with personal property, MCO, MSO, and COTs are not recorded in the land records. Instead, records of ownership are maintained by the manufacturer (up to their initial sale), then by the individual owner (until initial registration), and finally by the Mississippi Department of Revenue (after registration).

The following are samples of a MCO and COT:

Until July 1, 1999, Mississippi law did not mandate that manufactured homes be titled. That changed with the passage of Miss. Code Ann. § 63-21-9, as amended, which requires that manufactured homes built or assembled after July 1, 1999 (or which are the subject of first sale for use after July 1, 1999) be titled. Although, prior to July 1999, Mississippi did not require a COT for manufactured homes, COTs were often issued on those manufactured outside the state and Mississippians could opt into and request a COT for pre-1999 homes.

Needless to say, it is critical to determine (1) whether the DOR has a record of the manufactured home, (2) if so, how they show titled as being held, and (3) whether there are any lienholders. The easiest way to do so is to submit a record inquiry!

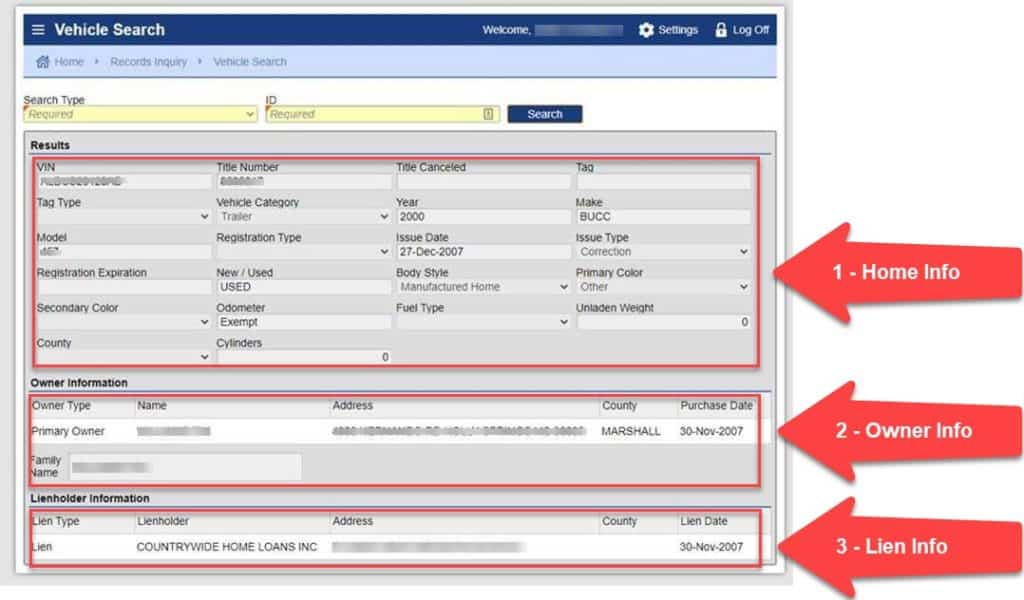

What does a “record inquiry” account show you?

What does a “record inquiry” account allow you to do? It allows you to search for a manufactured home using the home’s VIN/serial number or title number. If there is a hit, the search returns results that show who – according to the DOR records – is the current owner and current lienholder. Here’s a sample:

How do you register for a “record inquiry” account?

Registration is easy! Simply visit the DOR’s e-Services portal at https://mves.dor.ms.gov to create an online profile. After creating your profile, then simply register for a “record inquiry” account and pay the annual registration fee of $100.

If you have any questions on how to register, you can contact Lisa Chism, the Office of Property Tax Director, at (601) 923-7635.