5 Commerical Real Estate Hot Topics

Navigating the New Normal for Title ProfessionalsNavigating the New Normal for Title Professionals

BY JEREMY YOHE

Jeremy Yohe is ALTA’s vice president of communications. He can be reached at jyohe@alta.org

AS COMMERCIAL REAL ESTATE (CRE) ACTIVITY RAMPS UP IN 2025, title insurance professionals face a fast-evolving landscape. It’s essential for professionals engaged in commercial transactions, whether closing or underwriting, to consider the legal and ethical issues involved, use appropriate legal concepts to complex commercial scenarios and evaluate title insurance risks for the parties involved.

Len Prescott, director of underwriting for First American Title Insurance Company’s Agency Division, said title insurance professionals play a central role in these transactions, demonstrating their expertise to creatively, yet appropriately manage risk in support transactions that shape entire communities.

“It’s complex—but it’s also incredibly rewarding,” Prescott said. “Our role brings clarity to complexity. That’s what great underwriters—and great title insurance professionals—do every day.”

Here’s a breakdown of five critical topics and how they’re influencing underwriting decisions, closing procedures and risk management across the title country.

1. Foreign Ownership Restrictions and CFIUS Compliance

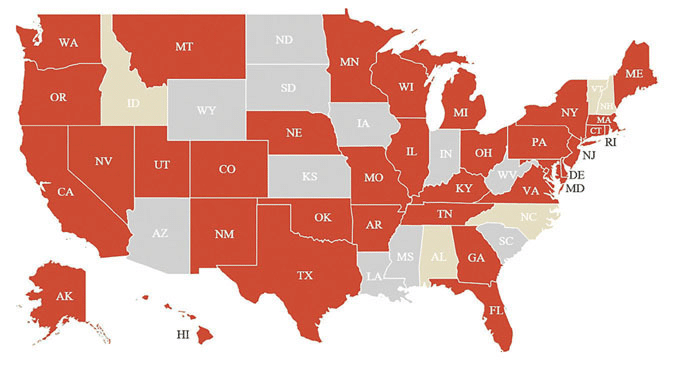

Foreign ownership of U.S. real estate has drawn growing scrutiny, particularly when national security concerns intersect with investment activity. In the past two years, both federal and state governments have expanded their authority to regulate land purchases by foreign nationals and entities.

The Committee on Foreign Investment in the United States (CFIUS)—a multiagency task force that reviews foreign investments for national security risks— has broadened its geographic focus to include any transaction within 100 miles of designated military installations. And that’s not just residential. Commercial properties are affected too.

“We’re seeing more lenders include CFIUS clearance requirements in their closing instructions,” said Nancy Landmark NTP, deputy chief underwriting counsel of commercial services for Stewart Title Guaranty Co. “That’s something we didn’t see even a year ago.”

Additionally, state legislatures have introduced a surge of bills restricting foreign ownership of agricultural, commercial and residential land— particularly by individuals from countries considered adversarial. More than 150 bills were tracked across states in 2024, and several are now law. Approximately 26 states have specific laws limiting foreign ownership of agricultural land, while some states restrict foreign ownership of public lands as well, according to the National Agricultural Law Center. State laws also have restrictions based on the type or classification of real estate and restrictions based on nationality or origin of the buyer.

Prescott emphasized title insurance professionals can’t afford to assume these laws don’t apply to commercial deals.

“This is not just about adding an exception. This affects underwriting decisions, policy liability and even whether a deal can close,” he said.

When you think in terms of commercial real estate, Prescott said there are lots of “gotchas.”

“Maybe it’s an agricultural property that’s part of the restriction, but agricultural property is not defined. So, residents with a chicken coop or a garden in the backyard, the question arises whether this is part of the agricultural property. And, if this is vacant land with the intent to build a residence or a one-to-four family apartment. Is that commercial or residential? These state laws often don’t line up.”

If a title agent closes a transaction that is restricted, Landmark said if there’s nothing in the closing instructions imposing liability, the transaction likely won’t be void. Rather, CFIUS will review and the buyer may be required to divest.

“You can close with relatively small risk,” Landmark added. “Nonetheless, underwriters will want to be careful with these transactions to be clear we are not providing coverage. We probably are not under the terms of Exclusion 1, but it’s better to be safe than sorry. It’s best to contact your underwriter and include an exception if needed.”

If there is something in the closing instructions, remember that closing liability is on closing office, not the underwriter,” Landmark added.

- The key takeaway: Know your property’s location, buyer’s status and the surrounding jurisdiction’s restrictions— then ask the right questions early.

2. Layered Capital Stacks and Alternative Lending Models

The CRE capital landscape is undergoing a structural shift. Traditional bank financing remains harder to access in 2025, pushing investors toward mezzanine debt, preferred equity and complex public-private partnerships to finance large developments.

“Every time you add a layer to the capital stack, you’re adding complexity— and risk,” Prescott said. “For us as title insurance professionals, that means more parties to the transaction, more policies and more scrutiny.”

Landmark gave a detailed example from a recent deal that included 12 separate title policies: fee ownership, long-term ground leases, multiple lenders and layered equity partners—all with different coverage needs.

“It’s the kind of transaction that requires coordination across multiple offices and teams. It’s intense—but also rewarding when you pull it off,” she said.

For projects using New Market Tax Credits (NMTC) or Low-Income Housing Tax Credits (LIHTC), underwriters must often evaluate overlapping entities and assess complicated ownership structures.

Fannie Mae Publishes List of Approved Underwriters to Handle Funding for Multifamily Deals

Fannie Mae published a list of title insurance underwriters it has approved to perform funding functions—except where limited by law—for multifamily mortgages.

Approved underwriters include:

- Alamo Title Insurance

- Commonwealth Land Title Insurance Co.

- Chicago Title Insurance Co.

- Fidelity National Title Insurance Co.

- National Title Insurance Co. of New York Inc.

- First American Financial Corp.

- First American Title Guaranty Co.

- First American Title Insurance Co.

- First American Title Insurance Co. of Louisiana

- Old Republic International Corp.

- Old Republic National Title Insurance Co.

- American Guaranty Title Insurance Co.

- Stewart Information Services Corp.

- Stewart Title Guaranty Co.

- Westcor Land Title Insurance Co.

Fannie Mae, which announced the new requirement in May, said it made the change due to several fraudulent transactions accounting for losses of nearly $300 million.

These changes are similar to escrow and settlement function requirements Freddie Mac announced last year.

ALTA has met with Fannie Mae and Freddie Mac since last year about these funding changes. ALTA will continue to engage with the agencies to share concerns members have with the new requirements.

Title companies are increasingly called upon to educate clients—especially first-time commercial developers—about how title insurance fits into these layered deals. That includes flagging risk exposures in mezzanine financing, explaining what title coverage does (and doesn’t) include and coordinating with lenders’ legal teams.

3. FinCEN’s New AML Rule: Beneficial Ownership Reporting

On Dec. 1, a new anti-money laundering (AML) rule from the Financial Crimes Enforcement Network (FinCEN) takes effect— and it’s poised to significantly impact title and settlement agents involved in non-financed real estate transactions.

This rule requires the reporting of beneficial ownership information when legal entities or trusts purchase property without institutional financing. Unlike the Corporate Transparency Act, which is paused due to legal challenges, this FinCEN rule is specific to real estate and does not depend on broader CTA litigation.

“The burden is going to fall on whoever closes and records the transaction,” Landmark explained. “In most cases, that’s going to be the title or settlement agent.”

The real challenge? There is still ambiguity around how “beneficial owner” is defined in certain contexts, especially when entities or trusts are involved. Compliance could involve collecting sensitive personal information and submitting it through a secure government portal.

FinCEN estimates the rule could cost the industry as much as $690 million in its first year due to increased compliance and technology demands.

“We have to get ahead of this now—educate staff, communicate with underwriters and talk to clients about what this means,” Prescott said. “If you’re waiting until December, you’re already behind.”

4. Fraud Trends: From Deed Theft to Synthetic Identity

Wire fraud continues to be a serious threat to real estate transactions. But in the commercial space, identity fraud, deed impersonation and synthetic entity creation are gaining ground.

“We used to say, ‘Fraud is mostly a residential issue.’ That’s no longer true,” Prescott cautioned.

One common trend involves vacant or unencumbered land. Fraudsters impersonate owners and attempt to sell the property— often successfully—before anyone realizes the documents were forged. These schemes are particularly dangerous because:

- There’s often no mortgage lender involved to provide an extra layer of due diligence.

- The parties may never meet in person.

- Scammers often target out-of-state or elderly property owners.

Prescott advised all agents to be highly skeptical of sellers who refuse to participate on video calls or insist on remote closings without ID verification.

Wire fraud also remains a threat, but awareness and recovery are improving thanks to tools like the FBI’s Recovery Asset Team (RAT) and private sector “fraud kill switch” programs.

“If you’re recalling a wire, make it clear you’re dealing with fraud—not just a change of instructions,” he urged. “That changes how banks prioritize the issue.”

5. Distressed Assets and the Rise of UCC Foreclosures

As interest rates remain elevated and nearly $1.8 trillion in CRE loans approach maturity, distressed sales are spiking. That includes:

- Deeds-in-lieu of foreclosure

- Note sales

- UCC (Uniform Commercial Code) foreclosures

The latter, Prescott noted, are often misunderstood.

“A UCC foreclosure isn’t a real estate foreclosure—it’s a sale of personal property, like a membership interest in an LLC,” he said. “But it can still trigger big title questions—especially if the new party wants to sell or refinance.”

In some cases, the foreclosure leads to a change in control of the entity that holds the property, which can result in ownership confusion and policy coverage disputes. Title agents are encouraged to carefully review:

- Operating agreements

- Organizational documents

- Public filings that show the chain of control

“If you’re reviewing a deed and something doesn’t look right—like mismatched signature blocks—it could be a red flag that a UCC foreclosure occurred,” Landmark warned.

Bonus Trends

- EB-5 Visa Developments: Despite scrutiny of “golden visa” programs, EB-5 remains active and often oversubscribed in 2025.

- C-PACE Loans: These Commercial Property Assessed Clean Energy loans are becoming more mainstream. They don’t typically show up in title insurance but can affect financing structure and lien priority.

“C-PACE loans aren’t just for green buildings anymore,” Prescott said. “We’re seeing them in downtown office conversions, hotels and mixed-use properties.”

It’s clear, title professionals must not only adapt to a changing environment— they must lead the way in understanding and communicating risks to clients.

“There’s no such thing as a ‘standard’ commercial deal anymore,” Landmark concluded. “Every one requires careful review, coordination and a commitment to education—both for your team and your clients.”

While commercial real estate is set for improvements in the coming year, the full impact of the Trump administration’s policies on this sector remains uncertain.

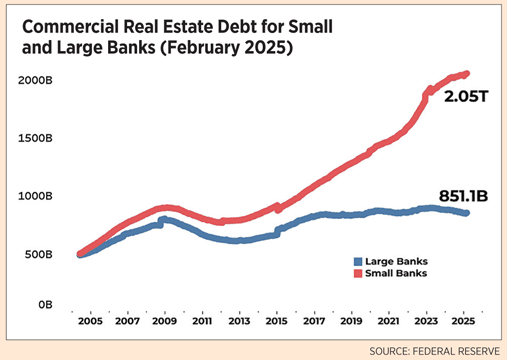

At the beginning of 2025, the National Association of Realtors reported office demand showed signs of recovery but wasn’t strong enough to push net absorption into positive territory. This left vacancy rates near record highs. The retail market stayed tight, constrained by a lack of new supply, while industrial vacancies continued to climb, contributing to a deceleration in rent growth. At the same time, the multifamily sector remained robust, with demand nearing the peak levels last seen in 2021. In February, NAR reported commercial real estate debt increased to $3.01 trillion, despite the Fed’s decision to hold rates steady for a second time this year. Meanwhile, the two anticipated rate cuts later this year are expected to further stimulate CRE investment activity.

By bank size, large domestically chartered banks saw their CRE loan balances increase to $848.7 billion compared to January, but down from $876.3 billion a year ago. In contrast, CRE lending by small domestically chartered banks continued to expand in February, posting a 2.7% increase year-over-year.

According to Federal Reserve data, delinquency rates for commercial real estate loans increased to 1.57% in Q4 2024, rising slightly from the previous quarter, but remaining 0.2% below the delinquency rate for residential real estate loans. Historically, though, commercial loan delinquencies have hovered near 1% over the past decade, while residential delinquencies averaged closer to 3%. So, according to NAR, the recent narrowing of this gap suggests that commercial real estate is now facing more pressure than in prior years.

_____________________________________________________________________________________________

American Land Title Association – direct link to article

Jeremy Yohe is ALTA’s vice president of communications. He can be reached at jyohe@alta.org