Multiple Indebtedness Deeds of Trust – What’s that?

Download: Multiple Indebtedness Deeds of Trust

Most Mississippians have never seen or heard the phrase “multiple indebtedness mortgage.” For those that have, it is often glossed over without a second thought. However, the words “multiple indebtedness” should be a RED FLAG. Stop, do not proceed. Do not pass go … and whatever you do … do not issue a commitment or policy insuring one without first discussing with your underwriter.

To understand why, we must take a look at this unique creation of Louisiana law.

Louisiana Mortgage Law

Real estate mortgages in Louisiana are subject to the “Mortgage” articles of the Louisiana Civil Code (La. Civ. Code arts. 3278, et seq.). There are three different forms of contractual or “conventional” real estate mortgages recognized in Louisiana:

- ordinary conventional real estate mortgages;

- collateral real estate mortgages; and

- multiple indebtedness mortgages.

Louisiana does not recognize deeds of trust.

An ordinary conventional mortgage may effectively secure only a single one-time extension of credit evidenced by a promissory mortgage note. An ordinary conventional mortgage will not effectively secure multiple loans or other extensions of credit on a cross-collateralization basis, nor will an ordinary conventional mortgage effectively secure multiple loan advances on a revolving line of credit basis.

A collateral mortgage is a special type of conventional real estate mortgage that has traditionally been used to secure multiple extensions of credit on a cross-collateralized basis, multiple loan advances extended on a revolving line of credit basis, as well as single one-time extensions of credit (La. R.S. §§ 9:5550, et seq.). Collateral mortgages are widely used in Louisiana, even in connection with single one-time extensions of credit when it may otherwise be appropriate to use an ordinary conventional real estate mortgage.

Multiple indebtedness mortgages (a “MIM”) serve the same purpose as collateral real estate mortgages. However, unlike a collateral mortgage, a MIM may secure multiple extensions of credit on a cross-collateralization basis. A MIM may also secure multiple loan advances under a secured revolving line of credit (La. Civ. Code art. 3298). A MIM differs from a collateral mortgage in that there is no need for a collateral mortgage note or for a collateral pledge agreement. In otherwords, a MIM may be recorded in Louisiana prior to a debt actually coming into existance. A MIM directly secures multiple extensions of credit or multiple loan advances on a line of credit basis. MIMs are widely used in Louisiana, even in connection with single one-time extensions of credit when it may otherwise be appropriate to use an ordinary conventional real estate mortgage.

Specific Requirements for Creating and Enforcing a MIM

Louisiana Civil Code expressly authorizes MIMs – i.e., mortgages that secure obligations that may arise in the future. See LSA–C.C. art. 3298(A). Louisiana is a civil code state. MIMs are not recognized under common law.[1] Rather, they are creatures of Louisiana’s civil code.

Under the hypothecary system of Louisiana, mortgages may be given to secure debts having no legal existence at the date of the mortgage. It is not essential in such a mortgage, even with respect to third persons, that it should express on its face that it was executed to secure future debts. It may be described as a security for existing debts, and yet used to protect those which, in the contemplation of the parties, are to be created at a future time. Pickersgill v. Brown, 7 La.Ann. 297 (1852); Commercial-Germania Trust & Sav. Bank v. White, 4 Pelt. 378 (La. Ct. App. 1921).

Because MIMs are a creature of statute, Louisiana courts have held that for a MIM to be validly created, the MIM must: (1) be granted in favor a specific mortgagee; (2) expressly provide that it secures the mortgagor’s present and future indebtedness to that mortgagee; (3) include in its definition of “Indebtedness” both present and future debt; (4) provide a specific, maximum indebtedness amount; (5) specifically reference La. Civ. Code art. 3298; and (6) provide the methods for canceling the MIM. See In re Hari Aum, LLC, 714 F.3d 274, 284–85 (5th Cir. 2013) (emphasis added).

Mississippi has neither a statute nor case law recognizing or authorizing MIMs.[2] Therefore, MIMs should not be used in Mississippi. This does not mean that all previously recorded MIMs are invalid. What it means is that the concept of a MIM is foreign to Mississippi law. Because MIMs are a special security instrument created and expressly authorized by statute in Louisiana, and because Louisiana courts have held that in order for a MIM to be valid, the MIM must reflect on its face 6 key elements, this type of security instrument should NOT be used in Mississippi.

Louisiana Title Insurance Statistical Services Organization (LATISSO) Endorsement for MIM

To further illustrate the uniqueness of a MIM, a special endorsement is generally issued with a loan policy insuring an MIM, which is known as the LATISSO 101 Multiple Indebtedness Mortgage Endorsement. This Louisiana specific endorsement modifies the standard 2006 Policy language to insure all advances made under the multiple indebtedness mortgage. Because these endorsements are not available in Mississippi, any title policy issued for a MIM recorded in Mississippi would not include the coverage provided by the LATISSO 101.

Key Points to Dealing With a MIM

Because Mississippi does not have a statute expressly authorizing the “multiple indebtedness” concept, and because of the number of unanswered questions associated with the same, you should encourage a lender using instruments titled as “multiple indebtedness deeds of trust” to switch to standard Mississippi deeds of trust. This helps ensure that there is no confusion regarding the necessity of the existence of indebtedness at the time the deed of trust is executed.

For those deeds of trust that don’t reference the “multiple indebtedness” concept, but do indicate they “may secure multiple notes,” then you should ensure that the instrument states on its face that it secures a line of credit.[3] This should help ensure that the instrument isn’t satisfied when the original note is paid in full and instead remains open to secure any future notes.

In any event, when a deed of trust shows an amount for the current note and a different maximum obligation, then the proposed policy amount should be the amount reflected as the “maximum obligation” and not just the amount of the initial note(s) referenced in the deed of trust.

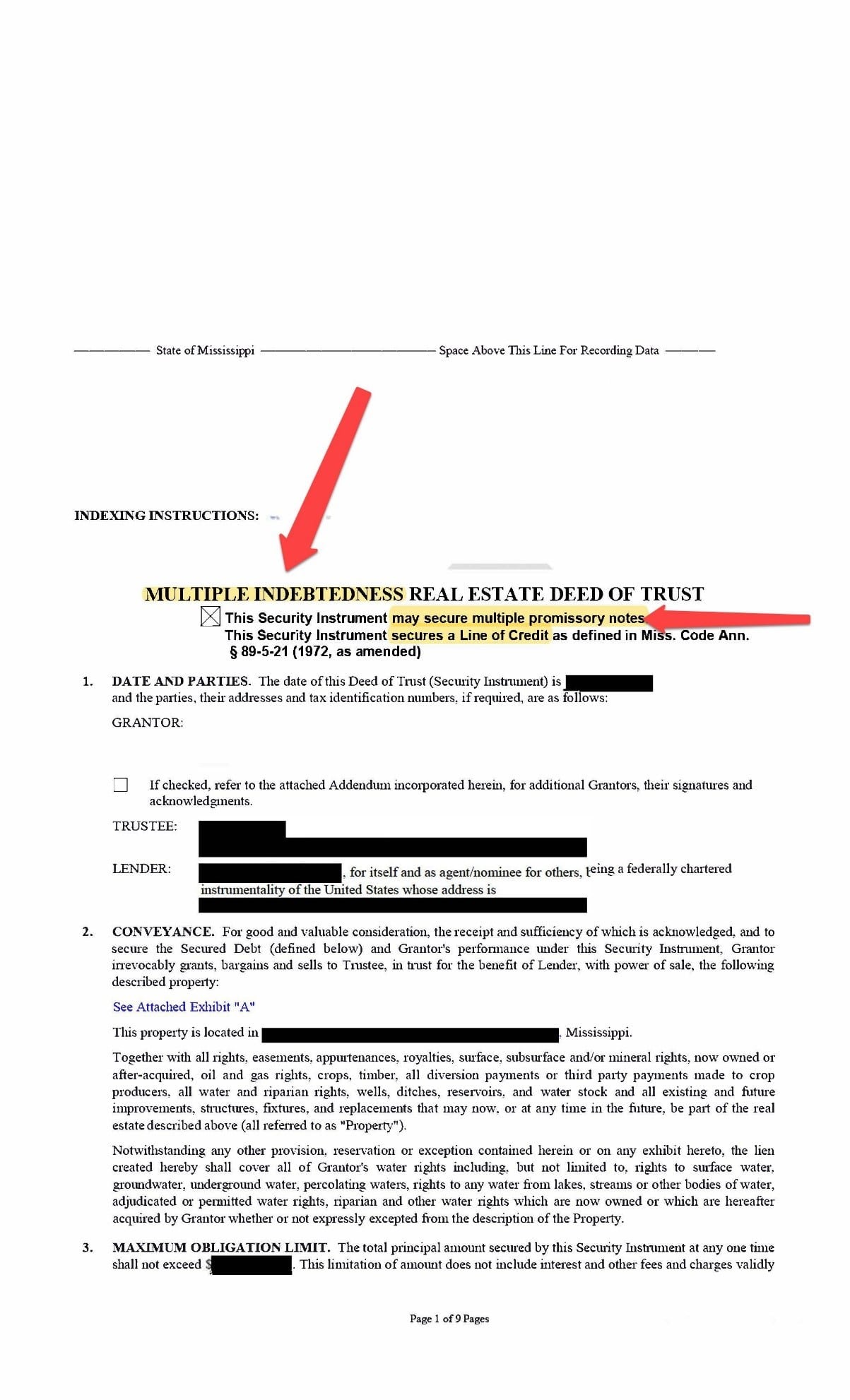

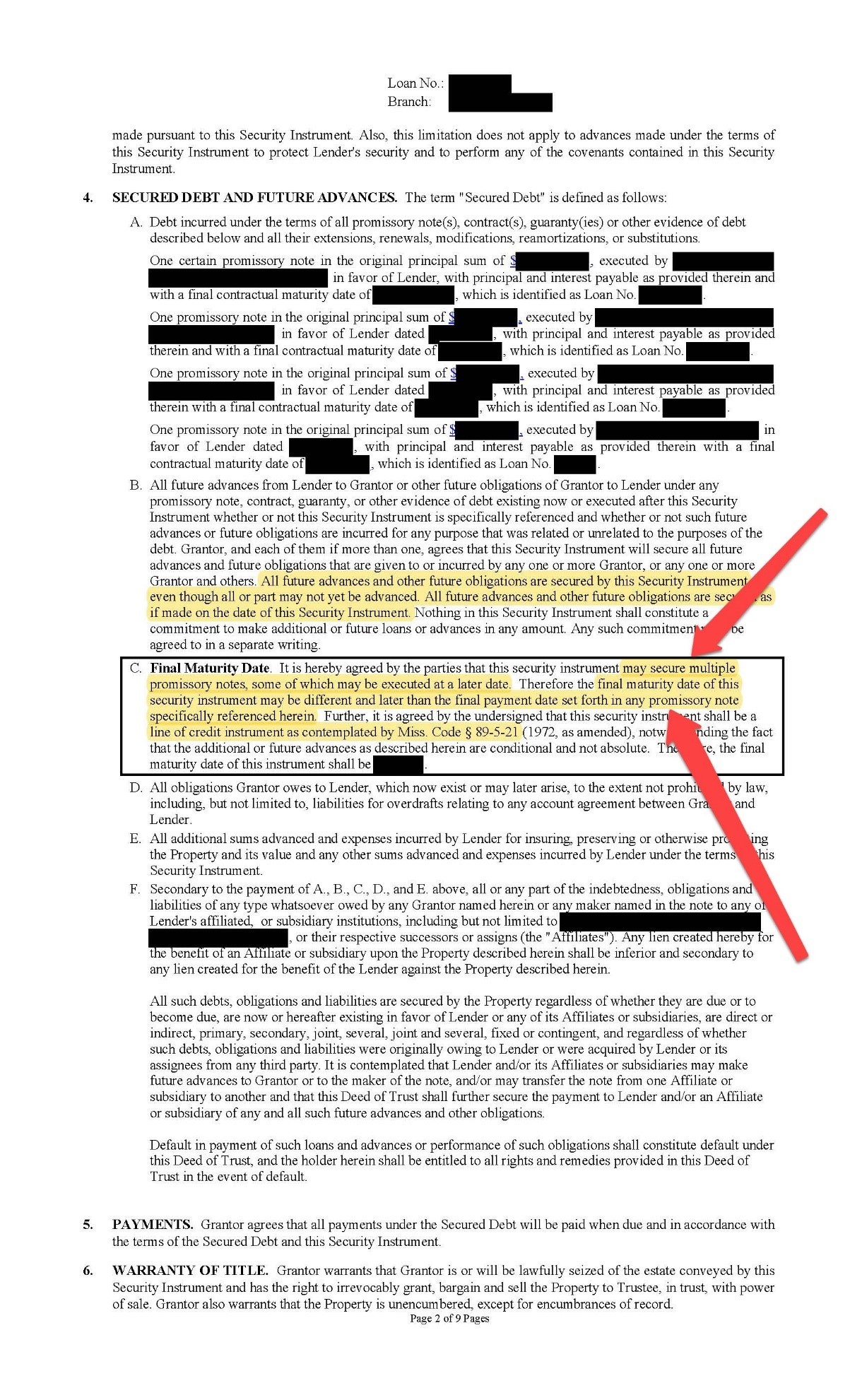

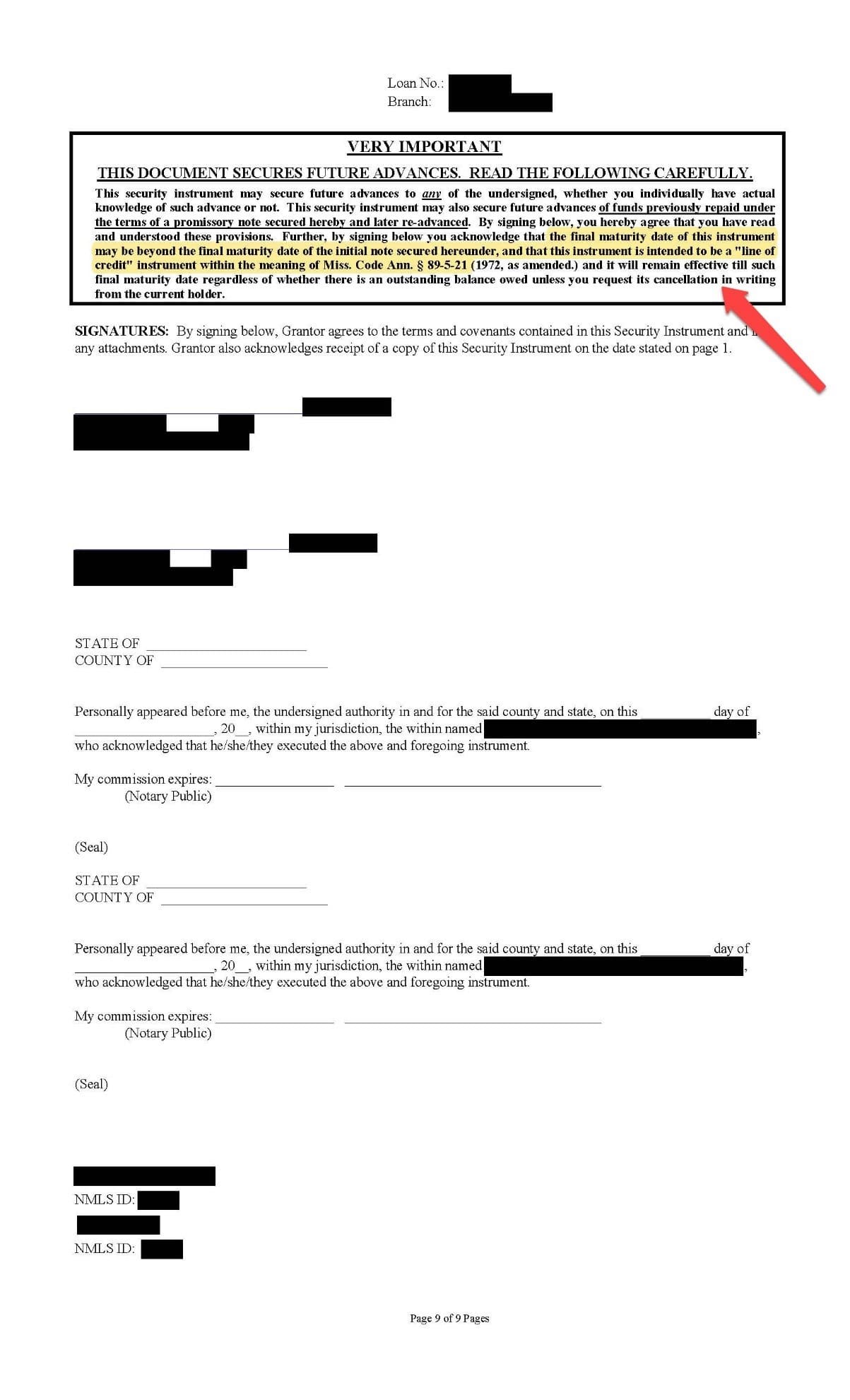

Example of MIM

Below is an example of a “multiple indebtedness” deed of trust. Some of the key phrases to look for are:

- “Multiple Indebtedness” in the title.

- Reference to “may secure multiple promissory notes, some of which may be executed at a later date.”

- Reference to “the final maturity date of this security instrument may be different and later than the final payment date set forth in any promissory note specifically referenced here.”

- Showing a “maximum obligation” way in excess of the request for a commitment.

Those that routinely work with Louisiana lender should have a discussion with those lenders and make sure that they use a standard Mississippi deed of trust. If you have questions regarding the insurability of a MIM, please contact your underwriter.

[1] Unless it secures an obligation, a mortgage is a nullity. See Restatement (Third) of Property (Mortgages) § 1.1 (1997). The existence of a debt or obligation is essential since the deed of trust is incident to and is measured by the repayment of the debt or performance of the obligation secured by it. § 51:6. Necessity for debt or obligation, 6 MS Prac. Encyclopedia MS Law § 51:6 (2d ed.). See also Hendrie v. Hendrie, 94 F.2d 534 (C.C.A. 5th Cir. 1938) (“[A] mortgage securing the note falls with it, as there can be no lien without a debt.”); Harris v. Kemp, 451 So. 2d 1362, 1365 (Miss. 1984) (when a debt has been extinguished by agreement of the parties, by the execution of a conveyance, and the mortgagor has the privilege of refunding and to a reconveyance, it is a conditional sale).

[2] A UCC financing statement can be filed before an indebtedness is incurred. Miss. Code Ann. Section 75-9-502(d) and Comment 1. A financing statement is only a notice that a lender may have a security interest, unlike a deed or deed of trust, which is the instrument of transfer itself, so these are apples and oranges.

[3] Where an obligation secured by a deed of trust is paid in full or otherwise satisfied, then the deed of trust is extinguished as a matter of law. See Miss. Code Ann. § 89-1-49. This statute has no application to a mortgage or deed of trust which states on its face that it secures a line of credit.